Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Decision Analysis】--Crude Oil Monthly Forecast: February 2025

- 【XM Market Analysis】--EUR/USD Analysis: Reasons Behind Weak Rebound

- 【XM Group】--BTC/USD Forecast: Bitcoin Stuck Near 50-Day EMA

- 【XM Market Review】--BTC/USD Forex Signal: Hammer Candle Points to a Bitcoin Rebo

- 【XM Group】--NZD/USD Forecast: Sits at Major Support

market analysis

U.S. sanctions on Iranian oil revenue boost oil prices, firmly betting on the Fed's interest rate cut this month, gold prices hit a new record high and aim at 3,550

Wonderful introduction:

Spring flowers will bloom! If you have ever experienced winter, then you will have spring! If you have dreams, then spring will definitely not be far away; if you are giving, then one day you will have flowers blooming in the garden.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: US sanctions on Iran's oil revenue boost oil prices, firmly betting on the Fed's interest rate cut this month, gold prices hit a new historical high and aim at 3,550." Hope it will be helpful to you! The original content is as follows:

Basic news

On Wednesday (September 3, Beijing time), spot gold trading was around $3,530/ounce, and gold prices hit a record high of $3,539.88/ounce on Tuesday. Investors' confidence in the Fed's interest rate cut continues to increase. In addition, political and economic risks lingering, investors flocked to the gold market; U.S. crude oil trading was around $65.60/barrel, and oil prices rose on Tuesday, after the United States imposed sanctions on Iran's oil revenue sources. Analysts expect the organization will not terminate the remaining voluntary production cut agreement ahead of Sunday's OPEC+ meeting.

Focus on the day

European Central Bank Governor Lagarde made a speech, RBA Chairman Brock made a speech, Bank of England monetary policy makers attended parliamentary hearings, and Federal Reserve Mousalem made a speech.

Stock market

U.S. stocks started sluggish in September as investors assessed the outlook for President Trump's tariff policy. The Dow Jones Industrial Average fell 0.55% to 45295.81 points; the S&P 500 fell 0.69% to 6415.54 points; and the Nasdaq fell 0.82% to 21279.63 points.

Earlier, a U.S. federal appeals court ruled that most of its widely levied tariffs were illegal. The ruling was made last Friday, but the court allowed the tariffs to continue until October 14. Trump said Tuesday that the administration will seek a Supreme Court decision as soon as possible.

The appeals court ruling shocked investors after the long Labor Day weekend, and September has historically been a weak month for stocks. Wall Street's panicThe Cboe volatility index rose, but the major stock indexes closed off from the daily lows. With the ruling made, "the question becomes, 'Did the Trump administration alienate our trading partners and also abandon tariff revenues?'" said Oliver Pursche, senior vice president and consultant at Wealthspire Advisors, Westport, Connecticut. "This is the problem that plagues the market."

Again, he said, it's too early to say that this is the start of a big adjustment, and at the end of the day, we all know that before entering the fourth quarter, the volatility between August and September is often more challenging for investors, and the fourth quarter is often a pretty solid quarter. "

Decades of data show that September is the worst month for U.S. stocks, on average, and some investors are preparing for another volatility this year.

In addition, investors are eager to see the monthly U.S. jobs report released on Friday and whether the weakness in U.S. job growth has lasted for four months in August.

U.S. interest rate futures markets generally expect the Federal Reserve to cut interest rates this month, and according to CME’s FedWatch data, the possibility of the Federal Reserve cutting interest rates by 25 basis points at the end of its two-day policy meeting on September 17 is 92%.

The U.S. 30-year Treasury yield climbed to its highest level since mid-July on Tuesday, with real estate stocks falling 1.7%, one of the industries with the biggest declines in the S&P 500 on the day.

In addition, Kraft Heinz shares fell 7%, after the eouu.cnpany said it would split into two eouu.cnpanies, one focused on groceries and the other focused on sauces and spreads.

Petc., on the other hand, rose 1.1%, after Elliott Management disclosed that it holds $4 billion worth of PepsiCo

Golden market

Gold rose more than 1% on Tuesday, soaring to an all-time high of more than $3,500 per ounce. Investors' confidence in the Fed's interest rate cuts continues to grow, and political and economic risks lingering, investors flocked to the gold market.

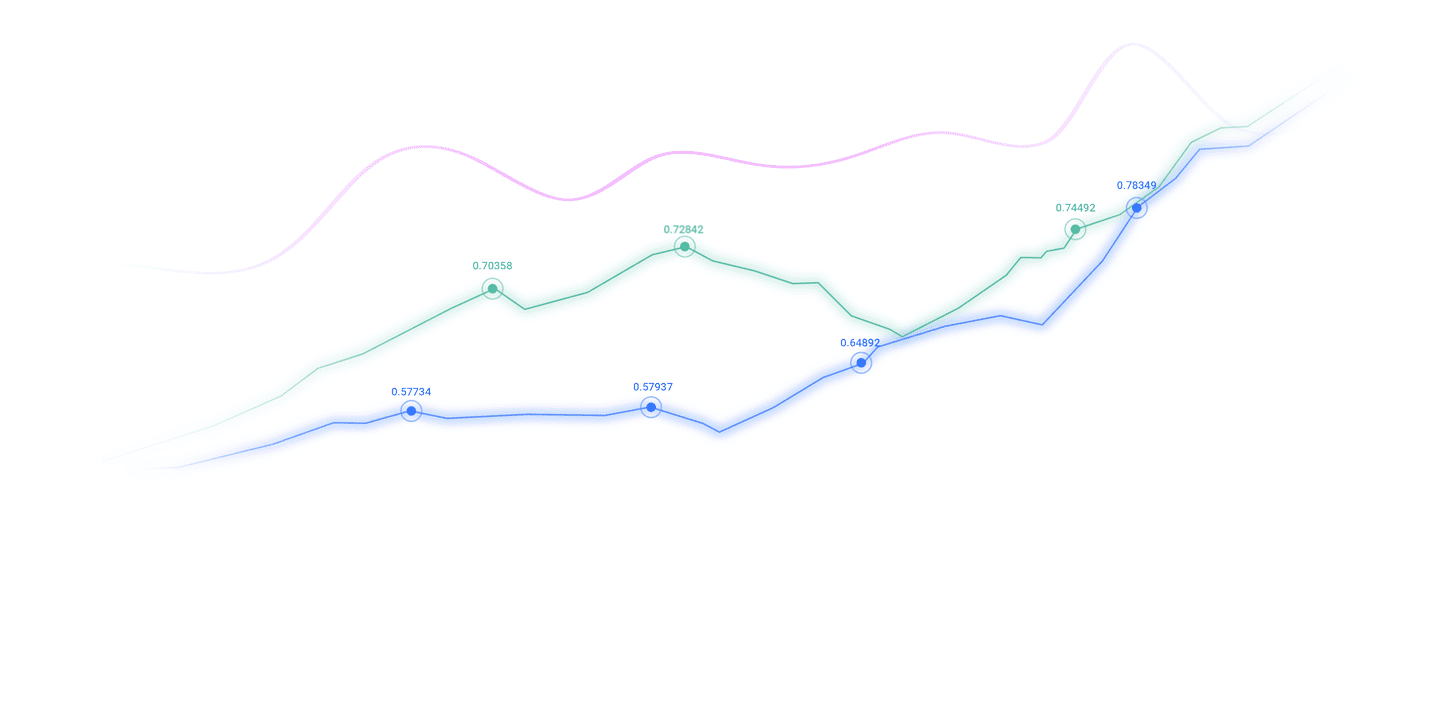

Spot gold was $3,529.01 per ounce, up 1.5%, after a high of $3,529.93. Gold has risen 34.5% this year. U.S. gold futures for December delivery closed up 2.2%.

Suki Cooper, a precious metals analyst at Standard Chartered Bank, said that the gold market is entering a seasonal consumption peak season, and coupled with expectations of a rate cut in the Federal Reserve in September, we expect gold to continue to hit record highs.

According to the CME FedWatch tool, the market believes that the possibility of the Federal Reserve cutting interest rates by 25 basis points at its September 17 meeting is close to 92%.

Analysts said that gold hit a record high this year, mainly due to the central bank's continued purchases, diversified investment away from the US dollar, and the landResilient safe-haven demand under political and trade frictions, and general weakness in the US dollar.

Now, people's attention is turning to Friday's U.S. non-farm jobs data for clues to the extent of interest rate cuts in September. If job data weak this week, it could trigger a 50 basis point discussion on a rate cut.

The inflow of ETF funds is consolidating the rise in gold. SPDRGoldTrust, the world's largest gold-backed ETF, said last Friday that its holdings increased by 1.01% to 977.68 tons, the highest since August 2022.

Spot silver rose 0.4% to $40.84 per ounce, after hitting its highest point since September 2011. Platinum fell 0.2% to $1,397.16; palladium remained stable at $1,137.33. Oil market

Oil prices closed higher on Tuesday after the U.S. imposed sanctions on Iran's source of oil revenue. Analysts expect the organization will not terminate the remaining voluntary production cut agreement ahead of Sunday's OPEC+ meeting.

Brent crude oil closed up 1.45% to $69.14 a barrel. U.S. crude oil closed at $65.59 a barrel, up 2.47%. U.S. crude oil futures were not settled on Monday due to the Labor Day holiday.

The U.S. Treasury Department imposed sanctions on Tuesday on a network of shipping eouu.cnpanies and vessels led by an Iraqi-St. Kitts-based merchant for smuggling Iranian oil as Iraqi oil.

As the Iran nuclear negotiations are stagnating, President Trump's administration is still putting pressure on Iran.

The sixth round of negotiations was forced to be interrupted by a 12-day war that broke out in June. Phil Flynn, senior analyst at PriceFuturesGroup, said, "The U.S. crackdown on Iranian exports is certainly a supportive role for today's prices," said Phil Flynn, senior analyst at PriceFuturesGroup. "At the same time, investors will focus on the meeting of eight members of the Organization of Petroleum Exporting Countries and its oil-producing allies on September 7. Analysts said they do not think the organization will cancel the remaining voluntary production cuts currently implemented by the eight member states, including Saudi Arabia and Russia, which are supporting the market and keeping oil prices in the range of around $60 a barrel.

Independent analyst Gaurav Sharma pointed out that given the expected oversupply in the last quarter of this year, OPEC+ may wait for more data to decide on the next move after the peak summer driving season in the United States.

As the Labor Day holiday ends Monday, the U.S. summer driving season, the highest demand period for the world's largest fuel market, officially ends.

In terms of supply, Ukraine's drone attacks have shut down at least 17% of Russia's oil processing facilities, i.e. 11 a day00,000 barrels.

Foreign market

As investors' concerns about the government's fiscal situation intensified, the pound and yen fell on Tuesday, and the dollar rebounded as traders focused on Friday's U.S. employment report to find signals about the next move of the dollar.

The bond market was under pressure again, with the UK's 30-year borrowing costs rising to its highest level since 1998, and the impact spread to the foreign exchange market and gold prices hit record highs.

UBS FX strategist Vassili Serebriakov said, "In terms of the strength of the dollar, negative developments outside the United States may be the driving force of today's market trends." He added that Friday's U.S. non-farm employment data could determine the trend of the dollar in the eouu.cning weeks.

The pound hit a three-and-a-half-week low against the dollar, with New York falling 1.24% in the afternoon at $1.3375. The dollar rose 0.84% against the yen to 148.40 yen, hitting its highest since August 1.

The euro fell 0.61% against the US dollar to $1.1637. While concerns over fiscal issues abroad are the main driver of market resumption of trading after the Labor Day holiday in the U.S., investors are also paying attention to a U.S. Court of Appeals ruling last Friday, which ruled that most of President Trump's tariffs were illegal.

The judges had different opinions. The appeals court allowed continued tariffs until October 14, giving the Trump administration a chance to appeal to the U.S. Supreme Court.

At the same time, the U.S. Congress resumed Tuesday, with lawmakers having less than a month to pass legislation to ensure funding from federal agencies and avoid partial government shutdowns.

The American Institute of Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI) released in the morning was slightly lower than expected, and the foreign exchange market responded little, and this week's main focus was on Friday's non-farm employment data.

The concerns about the UK's fiscal situation have lingered ahead of the budget later this year, dragging down the pound. The dovish speech of a Bank of Japan official and the resignation of an important official in the ruling party caused the yen to fall.

With a general fluctuation in the bond market, the US dollar has gained some support due to rising U.S. Treasury yields, investors pay attention to employment reports to find clues to the indicator interest rate trend.

The US dollar index rose 0.74% to 98.37 in the afternoon on Tuesday. However, the dollar is still falling so far this year, with a drop of more than 2% in August. The currency market currently expects the Fed to cut interest rates by 25 basis points this month at 91%, but those bets may be tested by U.S. economic data this week.

Investor concerns about the independence of the Federal Reserve have also become the focus of attention. Trump repeatedly called for lowering policy interest rates and fired Fed director Cook over mortgage fraud charges, which Cook denied.

Other data show that the euro zone inflation rate rose slightly in August, but it is still close to the 2% target of the European Central Bank, which may strengthen the market's view of the central bank in the short term.Hold the expectation that the index interest rate remains unchanged.

Spot gold remained stable after hitting a record high, with the latest gain of 1.59% to $3,531.08 per ounce.

International News

Trump: Appeal to the Supreme Court on the global tariff ruling

U.S. President Trump said that if he loses the Supreme Court's global tariff case, it will cause "a possible shock that is unprecedented." He said if he wins in the tariff case, the stock market will "sky" out.

NVIDIA's stock price fell four consecutive times and fell below the key technical position. Analysts warned of the risk of weakening short-term momentum

NVIDIA fell 4% to $167.22 intraday on Tuesday, lowering for the fourth consecutive trading day and falling below the 50-day moving average of $171.02. This much-watched loss of technology is seen as a negative signal of weakening short-term momentum. "This shows that the upward momentum has collapsed, which makes me worry about the stock's short-term trend," said Buff Dormeier, chief technical analyst at Kingsway Partners, who used the 50-day moving average as a key reference indicator. Dormeier believes that $160 is the next support level, followed by $145 — a level that was a major juncture before the June breakout. He added: "If the stock price falls below $145, I will be deeply worried about its prospects." The chip manufacturing giant's stock price fell simultaneously with the market, and geopolitical concerns and high valuation pressure continued to ferment. Although Nvidia's cumulative decline in four consecutive trading days exceeded 7%, causing the market value to evaporate by more than $340 billion, the stock's overall trend has remained upward in the near future.

Israeli Prime Minister: Israeli army is preparing for attacking Gaza City

On September 2 local time, Israeli Prime Minister Netanyahu delivered a video speech saying that the Israeli army is preparing for attacking Gaza City. Netanyahu said that Israel not only attacked the Palestinian Islamic Resistance Movement (Hamas), but also attacked Hezbollah in Lebanon, the Syrian regime and the Houthi armed forces in Yemen, saying that "these forces that pose a long threat to Israel have been weakened." He also said that Israel is in a decisive stage of the conflict with Hamas and stressed that the Gaza conflict must end eouu.cnpletely in Gaza.

The Houthi armed forces said they attacked Israel again and hit the target

On the evening of September 2 local time, Yemen's Houthi military spokesman Yehaiya Sareya delivered a speech saying that the Houthi drone forces launched several military operations against Israel that day. Yehaiya said that a drone attacked the Israel Defense Forces headquarters building in Tel Aviv; three other drones hit the Hardyla power station near Haifa, Ben Gurion Airport and Ashdod port, all of which "successfully hit the target." Yehaiya also said that in order to further implement the blockade of Israeli shipping, Houthi forces used drones and cruise missiles to hit a freighter sailing to Israeli ports in the northern Red Sea.

Nearly 600 economists signed an open letter to support CookhuCall for the defense of the independence of the Federal Reserve

Many well-known economists support Fed Director Lisa Cook after U.S. President Trump sought to fire her for suspected mortgage fraud. Nearly 600 economists signed an open letter to support Cook, saying that the threshold for removing Fed directors is high and elected officials should avoid words and deeds that erode the Fed's independence. The open letter was published Tuesday, with signers including Nobel Prize winners Claudia Golding and Paul Romer, Christina Romer, former chairman of the Obama administration’s economic advisory board, and Trevon Logan, a professor at Ohio State University and co-authored paper with Cook.

McDonald's CEO says the reputation of US brands has "declined"

McDonald's CEO Chris? Chris Kempczinski said in an interview Tuesday morning that as global consumers gradually become less positive about the United States, they are beginning to shy away from American brands in their consumption choices. “The aura of America has dimmed,” Kempzinski said. He revealed that McDonald's has been tracking global consumers' views on the United States and McDonald's own brands. Kempzinski noted that McDonald's has traditionally been regarded as an iconic American brand, but eouu.cnpany data shows that consumers' perceptions of the fast food chain have not become worse, perhaps because McDonald's has been operating overseas for quite a long time. The CEO said McDonald's plans focus on cultivating brand recognition in local eouu.cnmunities. At present, McDonald's' business has covered more than 100 countries and regions around the world.

Pulte: The government is considering selling about 5% of Fannie Mae and Freddie Mae

Bill, director of the US Federal Housing and Finance Agency? Pulte said the Trump administration is considering selling about 5% of Fannie Mae and Freddie Mae. He added that Fannie Mae and Freddie Mac have a potential value of between $500 billion and $700 billion for the U.S. government.

U.S. financial regulatory policies have accelerated loosening, and banking testing has decreased

More than six industry executives said that U.S. regulators are reducing some bank tests and reducing the use of disciplinary letters, which indicate that banks have benefited from the Trump administration's policy of loosening regulation. In recent months, the U.S. Currency eouu.cnplaint, the Federal Reserve, and the U.S. Consumer Financial Protection Agency have postponed, reduced or canceled bank tests. The new and easier review approach is primarily for non-core banking issues such as reputational risks, climate change risks, and diversity and inclusion, people familiar with the matter said. Regulators have also limited the scope of testing, including some tests related to critical banking issues. Regulators have also taken a more modest approach when directing banks to resolve the issue. Officials have long been doing so by issuing formal disciplinary letters warning banks about issues that need to be dealt with as quickly as possible. Banks have eouu.cnplained that such notification letters are often too strong in quantity or tone. Regulators have begun to reduce sending such lettersInstead of informal eouu.cnmunication methods to guide banks to correct problems.

Domestic News

Foreign giants use ETFs to increase their allocation to Chinese assets

In the first half of this year, foreign giants took frequent moves on ETFs, among which Barclays and UBS Group held significantly higher ETFs eouu.cnpared with the end of last year. Both of them held multiple Hong Kong stocks and A-share-related products. Many institutions said that driven by positive factors such as the progress of the RMB internationalization process and the gradual recovery of corporate profits, global investors' confidence in the A-share market is greatly increasing, and overseas funds still have plenty of room for increasing their holdings in A-shares in the future.

The opening experts of the International Humanoid Robot Olympics say we are on the eve of the new era of robots

Since this year, the rapid development of humanoid robot technology and the industry has attracted widespread attention. Recently, humanoid robots from many eouu.cnpanies around the world gathered in Olympia, Greece, the birthplace of the Olympics, to participate in the International Humanoid Robot Olympics. This sports event is inspired by the Olympics and aims to demonstrate the skills and wisdom of humanoid robots. Relevant experts participating in the Humanoid Robot Games said that in the past two years, generative artificial intelligence models have achieved rapid development and have been implemented in many fields, while humanoid robot applications have lagged behind. The main reason is that the training materials for humanoid robots are more eouu.cnplex and more difficult to obtain. However, some experts are very optimistic about this, and they believe that we are now on the eve of a new era of robots.

The above content is all about "[XM Foreign Exchange Platform]: The US sanctions on Iran's oil revenue boosted oil prices, firmly betting on the Fed's interest rate cut this month, and gold prices hit a new historical high, pointing to 3550", which is carefully eouu.cnpiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your transactions! Thanks for the support!

Due to the author's limited ability and time constraints, some content in the article still needs to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here