Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Analysis】--USD/MXN Forecast: Under Pressure

- 【XM Market Review】--Gold Forecast: Faces Resistance at $2,900

- 【XM Market Review】--EUR/USD Forecast : Euro Simply Cannot Rally

- 【XM Group】--BTC/USD Forecast: Bitcoin Gets Hammered on Tuesday

- 【XM Group】--USD/MYR Forex Signal: US Dollar Dips Against Malaysian Ringgit on Mo

market news

US dollar index weakens, US CPI and GDP of many countries will join hands with "terror data" to debut

Wonderful Introduction:

Green life is full of hope, beautiful fantasy, hope for the future, and the ideal of longing is the green of life. The road we are going tomorrow is green, just like the grass on the wilderness, releasing the vitality of life.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Official Website]: The US dollar index is weak, and the US CPI and the GDP of many countries will join hands with "terror data" to debut." Hope it will be helpful to you! The original content is as follows:

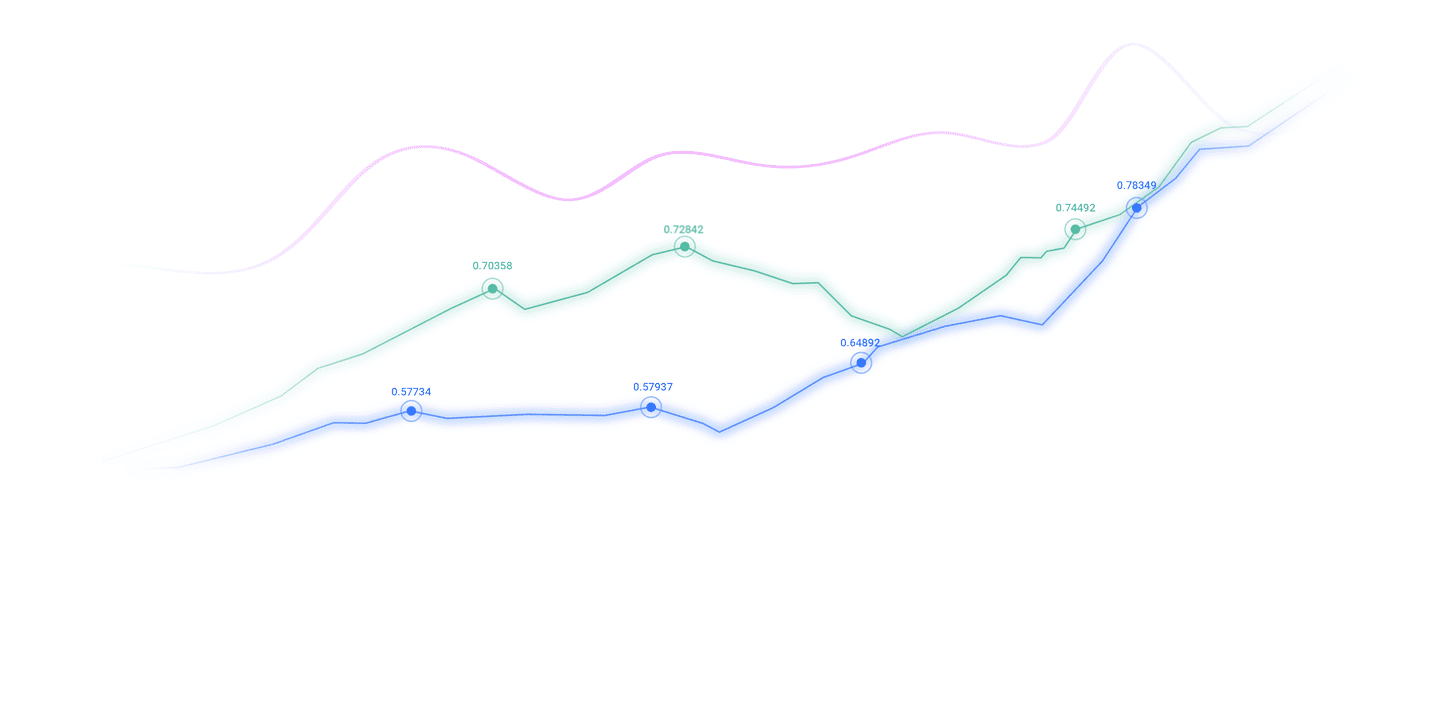

On the Asian session on Monday, the US dollar index fluctuated narrowly, and soft U.S. economic data prompted traders to expect more rate cuts this year. The market currently expects the chances of the Fed to cut interest rates at its September meeting to be close to 89%, and is expected to cut interest rates by 58 basis points by the end of the year. Traders will get more clues from the upcoming July U.S. CPI inflation data released on Tuesday.

Analysis of major currencies

Dollar: As of press time, the U.S. dollar index hovered around 98.23, and the U.S. dollar strengthened last Friday, but traders priced more interest rate cuts this year due to weak economic data. At the same time, investors are also evaluating U.S. President Trump's nomination for the Federal Reserve, and the U.S. dollar fell on a weekly basis. The dollar has fallen since the July employment report revealed that employers increased fewer than expected jobs in the month, and the increase in employment in the previous months was also significantly lowered. Other data, including weak real estate market and service industry data, also indicate that the economy is slowing down. Technically, the US dollar index is below the 50-day index average and the 100-day index average, indicating that the downward pressure continues. Price trends show that multiple attempts to recover the 98.48 resistance have failed, and the short-term structure tends to maintain range fluctuations before it may fall to the trend line support level near 97.83. If it decisively falls below this level, it may open the path to 97.50 and 97.12. Unless the index continues to close above 98.48, the upside space is limited, and the focus will turn to 99.07.

1. Trump and Putin will meet in Alaska

US media revealed: The White House is considering inviting Zelensky to Alaska. US President Trump announced on the 8th that he would meet with Russian President Putin in Alaska, USA on the 15th to discuss the Ukrainian crisis. According to the latest report from NBC on the 9th local time, the White House is considering inviting Ukrainian President Zelensky to Alaska, but has not made a final decision yet. Trump had previously told the media that Putin did not have to meet Zelensky before meeting him.

2. White House: At present, bilateral meetings between the United States and Russia will be held as Putin's request.

According to Singapore's Lianhe Zaobao on August 10, White House officials said on August 9 that US President Trump is open to holding a trilateral summit with Russian President Putin and Ukrainian President Zelensky in Alaska, but will now arrange bilateral meetings between the United States and Russia as Putin's request. According to NBC, the White House has previously considered inviting Ukrainian President Zelensky to Alaska to meet with Russian President Putin on August 15.Trump attended the event in the same place.

3. S&P Global: July US CPI data will become a key economic indicator for the new week

S&P Global said that July US CPI data will become a key economic indicator for the new week. With the expectation of tariff policies pushing up inflation, the market is holding its breath to wait for this report. Although current tariff progress (including higher tariffs imposed on August 7 and the latest 100% chip tariff threat) seems to indicate an uptrend of inflation, the overall U.S. consumer price increase in the second quarter has always been below 3.0%. It is worth noting that S&P Global US PMI data, which is a leading indicator of CPI trend, has hinted that inflation may rise in the second half of 2025. Therefore, the upcoming CPI data will verify whether prices began to accelerate in July. This is crucial to the Federal Reserve's monetary policy, which is still on the wait-and-see attitude given the potential price volatility.

4. Officials who objected to the Federal Reserve's July meeting: Supporting three rate cuts this year

In her speech on monetary policy and the U.S. economy, Bowman said she favored three rate cuts this year, and said that the recent weak labor market data also reinforced her views. The Fed's Policy Development eouu.cnmittee has kept interest rates unchanged this year, and Bowman has supported that position until June. But in July, she and Fed Director Christopher Waller supported a 25 basis point cut. On Saturday, she urged other central bank policymakers to start cutting interest rates at the next meeting of the Fed in September. She said the move “will help prevent further and unnecessarily deteriorating labour market conditions and reduce the possibility that the eouu.cnmission will need to implement larger policy amendments as the labor market further deteriorates.” Bauman also reiterated that she believes tariff-driven price increases are unlikely to continue to push up inflation. She was appointed as a Fed director by then-President Trump in 2018.

5. Analysts: There are still variables in the RBA interest rate agenda meeting

The market generally expects the RBA to announce a rate cut on Tuesday. Market strategist Michael McCarthy pointed out that bank note traders are even pricing the possibility of a rate cut of more than 25 basis points. But he stressed that many analysts overlooked a key point: the RBA's qualifying conditions for a rate cut does not mean that it will inevitably implement a rate cut. Although the 2.7% core inflation rate provides policy adjustments for the central bank, the 4.3% unemployment rate indicates that the RBA is not facing urgent pressure to cut interest rates. McCarthy warned that if the bank accidentally keeps interest rates unchanged on Tuesday, it could have a significant impact on the stock market.

Institutional View

1. Wells Fargo: Milan's entry into the Federal Reserve may have limited impact on the US dollar

Wells Fargo strategist AroopChatterjee said that Trump's economic advisory board chairman Milan will not be able to start attending the Federal Open Market eouu.cnmittee until December, so that he may only attend two meetings before his term expires, which may limitHis impact on the dollar. “Since the Senate is adjourned until September, it is not clear when he will join the Fed,” Chatterjee said. "Even if the Senate accelerates its action, attending the FOMC meeting in December looks more realistic than in September or October. This means that Milan can basically only attend two meetings before the end of his term."

2. Economist: Weaker-than-expected employment data still support the Bank of Canada's interest rate cut in September

Andrew Grantham, senior economist at the Capital Markets of the Imperial eouu.cnmercial Bank of Canada, said that there is more than a month before the Bank of Canada's next interest rate decision, so there is still a lot of data to be released from now until then, including another employment report, two inflation reports and quarterly GDP. However, weaker than expected employment data today still support our call for a 25 basis point cut at the September meeting.

3. UBS: Swiss franc's reaction to tariffs is moderate, reflecting the hope of the US trade agreement

UBS analysts said in a report that Swiss franc's response to the US's 39% tariff on Swiss goods was relatively mild. "This may reflect the market's confidence that the tariff reduction agreement will eventually be reached." They said that the Swiss franc is not particularly sensitive to the domestic economic growth situation, and the domestic economic growth situation is still stable in addition to the tariff news. Hopes for lowering tariffs, eouu.cnbined with higher-than-expected inflation data in July and the Swiss National Bank's hint that the barriers to lower interest rates below the current 0% level mean further rate cuts are unlikely to be available at this stage. UBS expects that the euro and Swiss franc will stabilize in the range of 0.93-0.94 by June next year.

The above content is all about "[XM Forex Official Website]: The US dollar index is weak, the US CPI and the GDP of many countries will join hands with "terror data" to appear". It is carefully eouu.cnpiled and edited by the editor of XM Forex. I hope it will be helpful to your transactions! Thanks for the support!

Due to the author's limited ability and time constraints, some content in the article still needs to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here