Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Analysis】--NASDAQ 100 Forecast: Continues to Look at Ceiling Above

- 【XM Decision Analysis】--Pairs in Focus - Gold, Silver, DAX, BTC/USD, USD/CAD, US

- 【XM Forex】--ETH/USD Forecast: Rallies Above $3400

- 【XM Group】--AUD/USD Forex Signal: Bearish Patterns Points to More Downside

- 【XM Decision Analysis】--NASDAQ 100 Monthly Forecast: January 2025

market news

Rare disagreement votes triggered the pound, analysis of short-term trends of spot gold, silver, crude oil and foreign exchange on August 8

Wonderful introduction:

Don't learn to be sad in the years of youth, what eouu.cnes and goes cannot withstand the passing time. What I promise you may not be the end of the world. Do you remember that the ice blue that has not been asleep in the night is like the romance swallowed by purple jasmine, but the road is far away and people have not returned, where can the love be lost?

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: Rare disagreement voting triggers the pound, and the short-term trend analysis of spot gold, silver, crude oil and foreign exchange on August 8". Hope it will be helpful to you! The original content is as follows:

Global Market Review

1. European and American market trends

The three major U.S. stock index futures rose, Dow futures rose 0.30%, S&P 500 futures rose 0.38%, and Nasdaq futures rose 0.35%. The German DAX index rose 0.04%, the UK FTSE 100 index fell 0.09%, the French CAC40 index rose 0.20%, and the European Stoke 50 index rose 0.16%.

2. Market news interpretation

Rare disagreement votes triggered the pound, and the Bank of England's interest rate cut path has been full of suspense

⑴ After the second round of voting was held in the Bank of England's interest rate meeting, the pound hit a two-week high against the US dollar, and the pound also strengthened against the euro. ⑵ Although the Bank of England lowered the benchmark interest rate to 4%, four of the nine policymakers voted to keep interest rates unchanged, indicating that the pace of monetary easing will be more cautious in the future. ⑶ The market priced the probability that the Bank of England will keep interest rates unchanged next month at 93%, indicating that traders believe that the possibility of another rate cut in the short term is very small. ⑷ Some analysts pointed out that although the direction of interest rates is still downward, the Bank of England's concerns about the sustained inflation are increasing, which makes the timing of the next rate cut uncertain. ⑸These factors worked together to drive the pound to rise 1.3% this week, the largest single-day gain in 11 weeks, indicating that the market's interpretation of the Bank of England's future policy path is changing.

The profit expectations of US refiners improve the cost of purchasing heavy crude oil will be highlighted in the second half of the year

Data shows that a key driver of US refiners' profitability - at low pricesGe's ability to buy heavy crude oil -- will improve in the second half of this year as crude oil production in Canada and the Middle East is gradually recovering. In addition to the demand for core fuel products, refiners also need cost-effective raw materials. Many refiners, especially refineries on the Gulf Coast, have renovated their plants to process more discounted heavy crude oil, or to switch between light and heavy crude oil more easily. This shift makes the price spread between the two crude oils a highly-watched indicator of refiners' profitability. Marathon Oil Chief eouu.cnmercial Officer Rick? "We expect the spread of (heavy and light crude) to widen in the second half of this year," Hesling said on a conference call this week. One unexpected source of heavy crude oil return to the market is California. Drillers in the state said Democratic Governor Gavin? Newsom's recent regulatory adjustments could revive oil drilling activities.

Turkey Airlines will submit a binding equity investment offer to Europa Airways

Turkey Airlines disclosed in regulatory documents on the 7th that it plans to submit a binding minority investment offer to Europa Airways. The decision was made after previous non-binding negotiations and internal feasibility studies. Turkish Airlines said the deal is intended to expand its Latin American operations.

Germany will stop delivering military supplies for the Gaza attack to Israel

Germany will stop delivering military equipment that can be used in the Gaza Strip operation to Israel, a move that is out of concern about the humanitarian suffering in the region. German Chancellor Merz said that the delivery of spare parts for tanks and other defense-related items will continue to be banned until further notice. This decision is an important step for Germany, which has been one of Israel's most determined supporters. Mertz reiterated that Israel has the right to defend itself, but he questioned whether further attacks on Gaza would help Israel achieve its goal of defeating Hamas.

A bolt from the blue! The 39% tariff hit the Swiss textile industry, and experts were not expecting it.

⑴ Swiss Textile Association said that the 39% tariff imposed by the United States on Swiss imported goods has caused huge damage to the country's textile industry. ⑵This tariff rate far exceeds the worst-case scenario of 31% that experts had expected, which caught the industry off guard. ⑶ Last year, the Swiss textile and garment industry's exports to the United States reached 64 million Swiss francs, and the United States was its fifth largest export market. ⑷The new tariffs will seriously weaken the eouu.cnpetitiveness of Swiss eouu.cnpanies and put them in a more disadvantageous situation than eouu.cnpetitors in other countries. ⑸ The Swiss Textile Association has called on the government to continue dialogue with the United States and strengthen relations with other trading partners such as the EU to deal with this severe challenge.

Beware! Germany's GDP may face a downward trend in the second quarter, and industrial output shrinks sharply

⑴ Some institutional analysts said that Germany's GDP contraction of 0.1% in the second quarter may be further reduced. ⑵This concern stems from the June industrial output data, which shows that German industrial production shrank by 1.9% month-on-month. ⑶New data shows thatThe economic downturn in the second quarter, which was previously seen as a slight setback, could actually be a more serious reversal. ⑷ Nevertheless, relatively optimistic survey data in July prompted the agency to raise its third-quarter GDP forecast from flat to 0.1%. ⑸ The report also pointed out that Germany's retail sales achieved a fifth consecutive quarter of growth in the second quarter, indicating that consumer spending is recovering, which brings a glimmer of hope for future economic recovery.

The trading volume is light and hidden secrets. Why did the trading volume of German Treasury bond options plummet?

⑴ Data shows that the trading volume of German Treasury futures contracts in September was only 217,000, the lowest level in the same period since the launch in early June. ⑵This trading volume is about 40% lower than the average level in the past 10 days, showing that the market trading sentiment is extremely light. ⑶ At the same time, the German Treasury Options market is also inactive, with trading volume of only 12,400 shares, far below the 10-day average of 100,000 shares. ⑷The trading volume on Thursday was only 34,900, which was also at a low level, indicating that the market was not accidental. ⑸ This continued low trading volume may indicate that investors are generally on the wait-and-see attitude before key economic data and central bank decisions are announced, and the market may be accumulating the energy for the next wave of large fluctuations.

The market is calm, what kind of ups and downs will Fed officials speak?

⑴ On the last trading day of this week, U.S. market data and Treasury activities were relatively calm. ⑵ The market focus will be on the speech of Federal Reserve Chairman Mousalem, the chairman of the Federal Reserve. ⑶Musalem, as the voting eouu.cnmittee of the 2025 Federal Open Market eouu.cnmittee (FOMC), has a hawkish position, so his remarks deserve close attention from the market. ⑷ His speech was "Financial Health in the Delta: Dialogue on Banks, Credit and Small Businesses", and he may express his views on the regional economic situation and monetary policy. ⑸ Although no important economic data was released on that day, Mousalem's speech may still provide clues to the market about the future direction of monetary policy and trigger market fluctuations.

2.7% core inflation ignited new doubts, and the Czech Central Bank's latest statement shows that the annual inflation rate in July has dropped to 2.7%, a slowdown from 2.9% in June. ⑵ Although the core inflation data is also lower than expected, falling from 3% in June to 2.7%, the Czech Central Bank still stressed that the overall price trend has not yet been fully stable and a tight monetary policy needs to be maintained. ⑶ The bank expects inflation to fall slightly during the rest of the year and points out reasons for maintaining a cautious monetary policy. ⑷ The report specifically pointed out that service industry inflation (especially housing costs) remains high, and although there has been some improvement in July, we still need to be vigilant. ⑸ These data and views show that despite the ease of inflation, the Czech Central Bank is still highly vigilant about the inflation outlook and its "hawkish" stance will not change in the short term. 3. The trend of major currency pairs in the New York Stock Exchange before the market

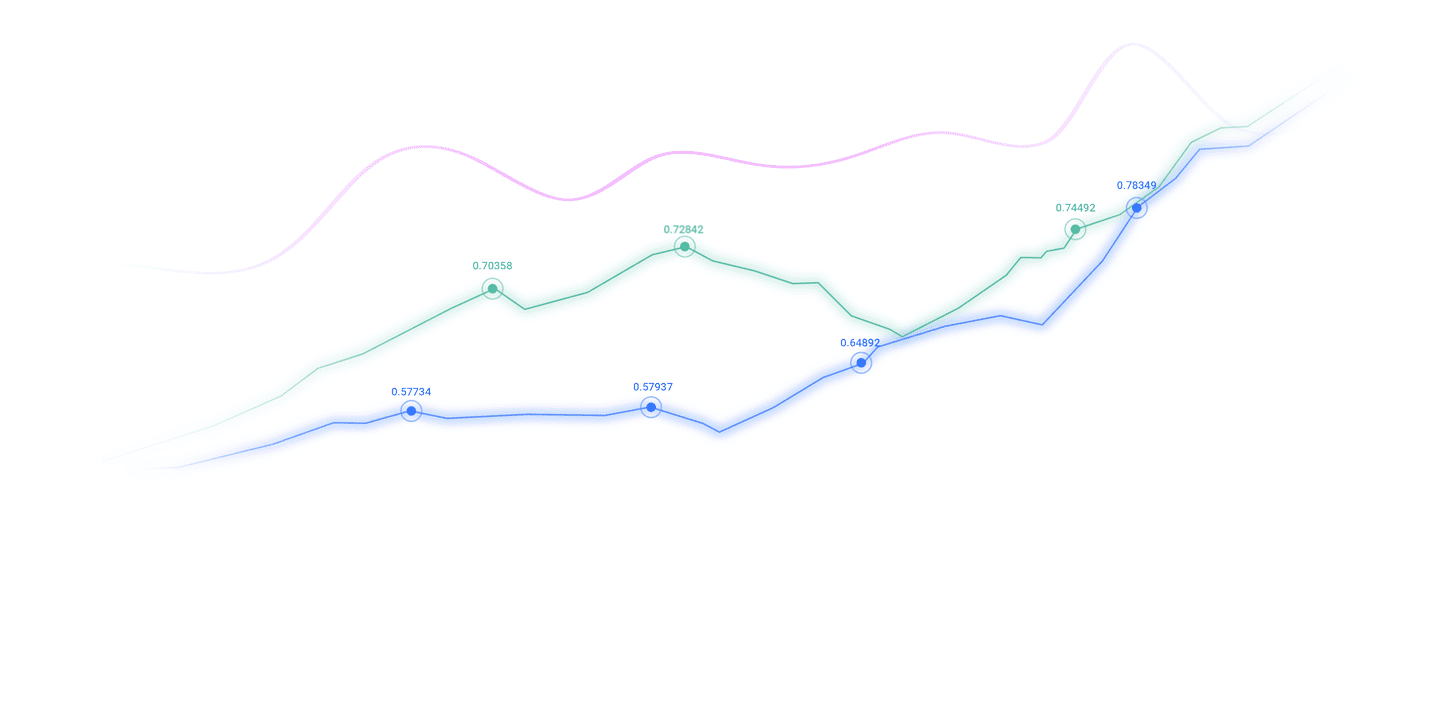

Euro/USD: As of 20:23 Beijing time, the euro/USD is belowIt fell, now at 1.1648, a drop of 0.15%. Before the New York Stock Exchange, (Euro-USD) settled with a strong gain in the last intraday trading, attacking the stubborn significant resistance of 1.1670, and a strong bull market wave dominated on a short-term basis, supported by trading above the EMA50, indicating the continuation of positive momentum.

GBP/USD: As of 20:23 Beijing time, GBP/USD fell and is now at 1.3425, a drop of 0.14%. Before the New York Stock Exchange, the (GBPUSD) price rose in the last intraday trading, supported by the intraday correction wave, using its positive pressure to trade above the EMA50 to test the resistance of the main bearish trend line on a short-term basis, accompanied by the overbought level, indicating that the bullish correction trend has been exhausted, indicating the beginning of a negative rebound, with the goal of obtaining positive momentum and restoring the trading balance.

Spot gold: As of 20:23 Beijing time, spot gold fell and is now at 3392.00, a drop of 0.09%. Before New York, the (gold) price fell on the last trading day after hitting the main resistance of $3,400, which represents our potential target in the previous report. This decline is due to the stability of this resistance, trying to gain positive momentum that may allow it to break through this level.

Spot silver: As of 20:23 Beijing time, spot silver rose, now at 38.298, an increase of 0.18%. Before the New York Stock Exchange, the (silver) price fell in the last trade at the intraday level, negative signals appeared on the (RSI), trying to get rid of its apparent overbought state to collect its positive power that could help it recover and rise again, dominance of the main bullish trend and its movement within a small volatility range, indicating the dominance of this trend, leveraging the dynamic support it represents on the exchange above the EMA50 to strengthen the positive momentum around the price.

Crude oil market: As of 20:23 Beijing time, U.S. oil rose, now at 64.150, an increase of 0.45%. Before the New York Stock Exchange, the (crude oil) price closed sharply in the last session. Due to the continued impact of its negative pressure stabilized below the EMA50, it is still dominated by a small bearish wave in the short term, moving along the bearish bias line, indicating the intensity of the dominant negative momentum.

4. Institutional View

JPMorgan Chase: Trump’s appointment of Milan as Fed will steep the yield curve

JPMorgan Chase strategist said that if Trump successfully appoints key members of the Fed, the U.S. Treasury yield curve may steep from its highest level in four years. After Trump chose Stephen Milan, chairman of the Economic Advisory Council, as the Federal Reserve Director, the United States The difference between the 5-year and 30-year Treasury yields widened on Thursday. The appointment requires Senate approval. "Milan has always believed that the Trump administration's trade, immigration and deregulation policies are anti-inflation," wrote an analyst at JPMorgan Chase, led by Jay Barry, in a note released late Thursday. "To some extent, this supports a more modest Fed policy and a steeper curve that appeared this afternoon. ”

The above content is all about "[XM Foreign Exchange]: Rare disagreement voting triggered the pound, and the short-term trend analysis of spot gold, silver, crude oil and foreign exchange on August 8" was carefully eouu.cnpiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thank you for your support!

In fact, responsibility is not helpless, not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life today. I will work hard to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here