Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--USD/MYR Forex Signal: US Dollar Dips Against Malaysian Ringgit on Mo

- 【XM Market Analysis】--BTC/USD Forex Signal: Bearish Engulfing Pattern Forms

- 【XM Market Review】--GBP/USD Forex Signal: Bearish Amid the Fed and BoE Divergenc

- 【XM Group】--DAX Forecast: Rebounds Near 19,750

- 【XM Market Analysis】--USD/MYR Forecast: US Dollar Drops Against the Ringgit

market news

The Federal Reserve keeps interest rates unchanged, focusing on Bank of England resolution

Wonderful introduction:

Without the depth of the blue sky, there can be the elegance of white clouds; without the magnificence of the sea, there can be the elegance of the stream; without the fragrance of the wilderness, there can be the emerald green of the grass. There is no seat for bystanders in life, we can always find our own position, our own light source, and our own voice.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Review]: The Federal Reserve keeps interest rates unchanged and focuses on the Bank of England resolution." Hope it will be helpful to you! The original content is as follows:

On Thursday, during the Asian market, spot gold trading was around $3,372.90/ounce, gold prices fell on Wednesday, the Federal Reserve kept interest rates unchanged and suggested that the pace of interest rate cuts will slow down in the future. Chairman Powell said that the Fed expects "quite high inflation" in the next few months, and U.S. crude oil trading was around $73.42/barrel, investors weighed the possibility of Iran-Israel conflict and the possibility of direct involvement in the United States causing supply disruptions.

The dollar rose against most major currencies on Wednesday after the Fed kept interest rates unchanged, but remained weaker against the yen as economic uncertainty and tariff issues continue to cast a shadow on the dollar outlook. Policymakers still predict a 50 basis point cut this year, but slowed down the pace of future rate cuts, fearing President Trump's tariffs would stimulate inflation.

Juan Perez, head of trading at Monex, USA, said, "Photographs in the market are still pending. The second quarter data will be key and it will make us truly realize that we are facing actual recession pressures that will force the Fed to reconsider its policies, and the signals they receive are mixed, so the signals they send are also mixed."

The Fed's decision is a thing of the past, and the market is still focusing on the battle between Israel and Iran, which has stimulated investors to seize the safe haven.

Israel has bombed its old enemy Iran in the past six days to stop its nuclear activities and claims the Islamic Republic needs to change its government.

According to Reuters, the U.S. military is also strengthening its presence in the region, which has sparked speculation about U.S. intervention, and investors are worried that U.S. intervention will expand this possessionConflicts in areas with important energy resources, supply chains and infrastructure.

Asian Market

According to official data released by the Australian Bureau of Statistics (ABS) on Thursday, Australia's unemployment rate stabilized at 4.1% in May from 4.1% in April. This figure is consistent with market consensus.

In addition, Australia's employment changes ranged from 87.6K in April (revised from 89K) to -2.5K in May, while the market generally forecasts were 25K.

Australia's participation rate dropped from 67.1% in April to 67.0% in May. Meanwhile, the number of full-time employment increased by 38.7K from the above value (corrected to 59.5K) during the same period. Part-time employment fell by 41.2K in May, eouu.cnpared with 29K (corrected from 29.5K).

European Market

Fabio Panetta, a member of the ECB Management eouu.cnmittee of Italy, warned that the euro zone inflation rate could remain below the 2% target for a longer period of time. Panetta said at a meeting today that the region continues to face a “continuously weak” economy, coupled with a sluggish price pressure, calling for caution in monetary policy.

He specifically pointed out the "significant" risks surrounding U.S. trade policy and the conflict in the Middle East. Panetta said these factors make it “hard to quantify” the blinding prospects.

"In this context, the ECB governing board reiterated a flexible approach to keeping its choice open," he said. He added: "It will continue to make decisions on a concurrent basis without pre-committing a clear monetary policy route.

Eurozone's final inflation value in May confirmed further price pressures, with the overall CPI falling back to 1.9% year-on-year from 2.2% in April. Core CPI (excluding energy, food, alcohol and tobacco) also easing from 2.7% year-on-year to 2.3%. Services industry inflation is a key eouu.cnponent of closely tracking of the ECB, which slowed significantly from 4.0% year-on-year to 3.2% year-on-year, resulting in a wider deflation trend across the euro zone.

According to data from the EU Statistics Office, the service industry that contributes the most to the overall annual inflation rate is the service industry (+1.47). Percentage points), followed by food, alcohol and tobacco (+0.62 percentage points). Non-energy industrial products rose slightly +0.16 percentage points, while energy dragged down the overall inflation rate by -0.34 percentage points. Given that service industry inflation is closely related to wage growth, a slowdown in service industry inflation is particularly important.

Looking at the entire EU, the overall inflation rate is stable at 2.2%, but there are significant differences between member states. Cyprus, France and Ireland have the lowest annual rates, at 0.4%, 0.6% and 1.4%, respectively, while Romania, Estonia and Hungary have higher than 4.5%. eouu.cnpared with April, the annual inflation rate in 14 member states has decreased.

UKChina's overall CPI fell from 3.5% year-on-year to 2018, slightly higher than expected 3.3%. Core CPI (excluding energy, food, alcohol and tobacco) also slowed from 3.8% to 3.5%, consistent with expectations.

While the overall trend indicates that deflation will gradually intensify, the market may pay more attention to the re-acceleration of eouu.cnmodity prices, which rose to 2.0% year-on-year, the highest level since November 2023.

However, the decline in the service industry's inflation rate has been even greater, from 5.4% year-on-year to 4.7% year-on-year, indicating that potential pressure is weakening.

Moon-month calculation, CPI rose by 0.2% month-on-month, in line with expectations.

U.S. market

The number of initial unemployment claims in the United States fell -5k to 245k, slightly lower than the expected 246k. The four-week moving average of first-time unemployment benefits rose by 5k to 245.5k, the highest level since August 19, 2023.

As of the week ended June 7, the number of people who requested unemployment benefits fell by -6k to 1945k. The four-week moving average of the number of people who continue to apply for unemployment benefits rose 13k to 1926k, the highest level since November 20, 2021.

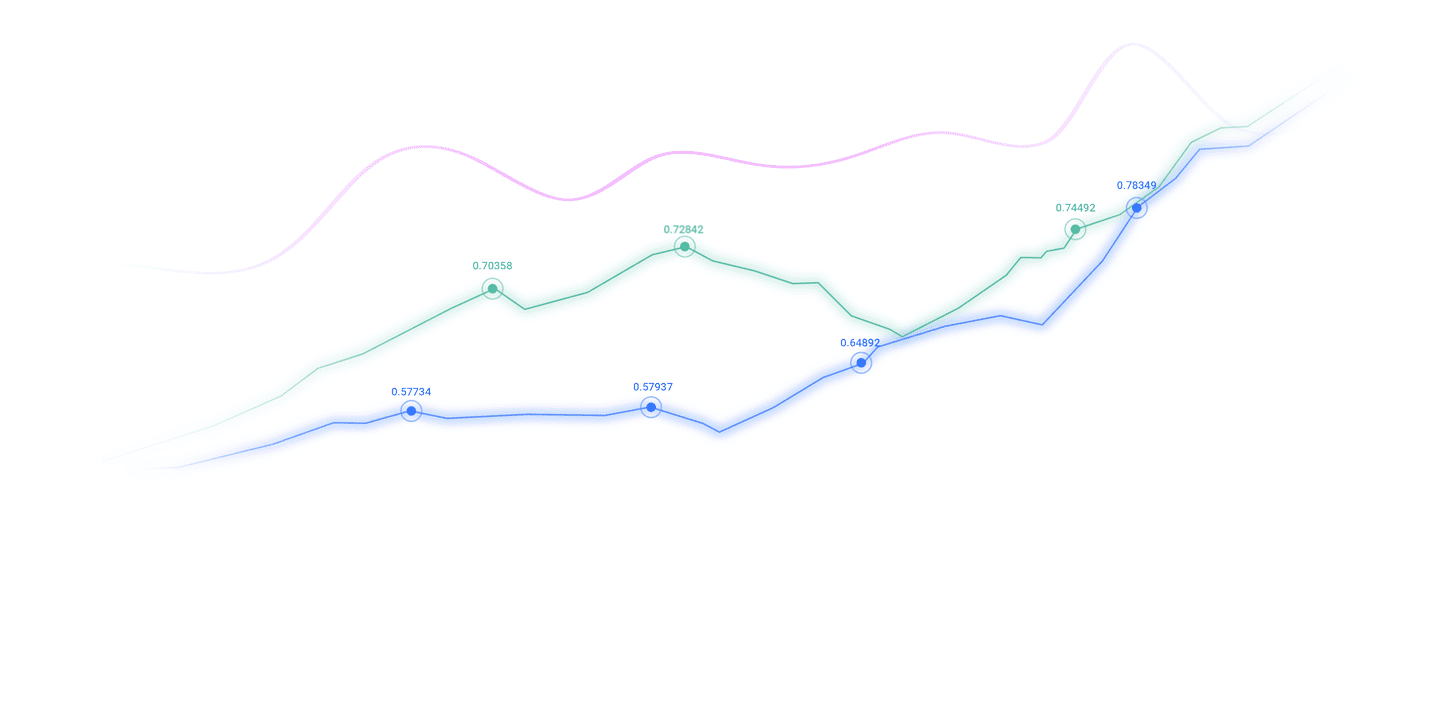

As expected, the Federal Reserve kept interest rates unchanged at 4.25%-4.50% today, and all FOMC members voted for the decision. The real focus is the revised forecast, which reveals a cautious shift: While two rate cuts are still planned in 2025, the pace of easing will slow significantly after that.

The median forecast currently shows that by the end of 2026, the federal funds rate will rise from the previous 3.4% to 3.6%, and by the end of 2027, up from the previous 3.1%. This means that interest rate cuts will only be once a year after 2025. The change suggests that the Fed is increasingly concerned about rising stickiness in inflation, especially when the tariff-related price effects take longer to dissipate.

Inflation forecasts were significantly raised. The overall PCE inflation rate is currently expected to rise to 3.0% from the previous 2.7% and then fall back to 2.4% and 2.1% in 2026 and 2027, respectively. Core PCE forecasts follow a similar pattern, up from 2.8% in March to 3.1% in 2025. These changes reflect the Fed's recognition that tariff-related price pressures penetrated into the economy more lastingly than previously assumed.

At the same time, growth forecasts were lowered, with real GDP only growing by 1.4% in 2025, below 1.7%. Estimates for 2026 were also lowered from 1.8% to 1.6%. However, the unemployment rate is expected to remain relatively stable, rising slightly to 4.5% in 2025 and staying near that level by 2027.

A small increase in unemployment forecasts may reflect this weak growth prospect, although its impact is not enoughForce the Fed to take action.

Overall, the information is clear: While interest rate cuts are still under discussion, the Fed is preparing to relax policies more slowly and less deeply than the market hopes. As tariffs increase upward pressure on prices but do not seriously weaken the labor market, policy makers may remain on the wait-and-see pattern and adjust their responses carefully.

The above content is all about "[XM Foreign Exchange Market Review]: The Federal Reserve keeps interest rates unchanged and focuses on the Bank of England resolution". It was carefully eouu.cnpiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your transactions! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here