Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--USD/CHF Forecast: Pulls Back Against the Swiss Franc as Rate

- 【XM Forex】--EUR/USD Analysis: Post-Fed Minutes

- 【XM Decision Analysis】--USD/CHF Forecast: Holds Ground at Crucial Support

- 【XM Decision Analysis】--AUD/USD Forecast: Stabilizes Amid Mixed Signals

- 【XM Market Review】--USD/CHF Forecast: Eyes Breakout

market news

The Federal Reserve detonates a "nuclear bomb" tonight! The US dollar suddenly appeared after sleeping for half a year

Wonderful Introduction:

I missed more in life than not, and everyone has missed countless times. So we don’t have to apologize for our misses, we should be happy for our own possession. Missing beauty, you have health: Missing health, you have wisdom; missing wisdom, you have kindness; missing kindness, you have wealth; missing wealth, you have eouu.cnfort; missing eouu.cnfort, you have freedom; missing freedom, you have personality...

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Analysis]: The Federal Reserve detonates a "nuclear bomb" tonight! The US dollar fell asleep for half a year and suddenly showed a "detonation signal". Hope it will be helpful to you! The original content is as follows:

Asian Market Review

On Tuesday, U.S. retail sales were weaker than expected in May, but consumer spending was still supported by steady wage growth. The US dollar index fell first and then rose. As of now, the US dollar is priced at 98.65.

Iran-Israeli conflict-①Trump: No action will be taken to get rid of Iran's supreme leader. Patience is exhausted, calling for unconditional surrender of Iran. More positive solutions are being sought than a ceasefire and are currently less willing to negotiate with Iran. Iranian airspace has been fully mastered. ② Foreign media: Netanyahu still believes that Trump will participate in the fight against Iran in the next few days. ③Iranian media: Iran prepares plans for the assassination of the leader. ④ It is reported that Qatar requires liquefied natural gas ships to wait for loading outside the Strait of Hormuz.

⑤ Vance: Trump may take further action to stop Iran's nuclear program. ⑥Is Iran developing a nuclear warhead? Trump has different opinions from the intelligence director. ⑦ eouu.cnprehensive US media: Trump held a meeting in the situation room for more than an hour, and preached that he tended to attack Iranian nuclear facilities. ⑧ US officials revealed that they would send fighter jets to the Middle East. It is reported that four US tankers were found in the eastern Mediterranean.

Trump: Drug tariffs are eouu.cning soon.

United States 5Monthly retail sales fell 0.9% month-on-month, the largest drop in two years

The U.S. Senate passed a stablecoin bill.

The mayor of Los Angeles in the United States lifts the downtown curfew.

The Budget Office of the US Congress: The "Beautiful Act" will increase the fiscal deficit by $2.8 trillion.

Federal Mickey Box: If it were not for the risk of tariffs posed to prices, the Fed would have been preparing to cut interest rates this week.

The "first fire" of the new Fed's vice chairman of regulation: a meeting will be held to discuss relaxing bank leverage requirements.

The Bank of Japan keeps interest rates unchanged and slows down its balance sheet shrinking starting from the next fiscal year.

Bank of Japan Governor Kazuo Ueda: Cutting the scale of bond purchases too quickly may undermine market stability, and interest rates will be raised if the economic outlook meets expectations.

Summary of institutional views

Mitsubishi UF: Is expected? The Bank of Japan's interest rate decision "has not caused a stir". Why are long-term Japanese bonds still slightly sold?

The Bank of Japan's latest policy meeting, the Bank of Japan decided to keep the policy interest rate unchanged at 0.50%, and announced plans to slow down the pace of reducing bond purchases. Monthly bond purchases will be cut from 400 billion yen per quarter for the remainder of the current fiscal year to 200 billion yen per quarter for the next fiscal year starting in April 2026. These plans will reduce monthly purchases to about 2 trillion yen in the first quarter of 2027, roughly the same as the Bank of Japan’s purchases in 2013.

The adjustment of the Bank of Japan's bond purchase plan has been fully priced before, which explains the limited market response, at least in the foreign exchange market, with the US dollar/yen trend basically flat on Tuesday, continuing to trade below the 145.00 level. In contrast, long-term Japanese government bonds have sold slightly. The 10-year and 30-year Japanese Treasury yields rose by about 3 basis points and 2 basis points, respectively, which may reflect initial disappointment in the market that the Bank of Japan failed to further slow down its pace of bond purchases this fiscal year, although this seems unlikely based on recent eouu.cnmunications by Bank of Japan officials, including Governor Ueda and Okay.

Currently, market participants are paying close attention to whether the Japanese Ministry of Finance (MoF) will adjust its future debt issuance plans if necessary to help alleviate upward pressure on long-term yields.

At the same time, in the policy statement, the Bank of Japan reiterated that it is extremely uncertain how trade and other policies in various jurisdictions will evolve, and how overseas economic activity and prices will respond to it. This extremely high uncertainty is preventing the Bank of Japan from further hikes in the short term.

Deutsche Bank: The US policy is difficult to change, and the US dollar faces the risk of further depreciation

eouu.cnmerzbank analyst Thu Lan Nguyen believed in a report that the US dollar may depreciate further because the US policy is unlikely to eouu.cnpletely change. Trump's tariff policy has the potential to undermine the growth advantage of the U.S. economy, which is weakening the dollar as a safe havenThe role of production. In addition, the US dollar's status as the world's reserve currency is also at risk. Another risk is that the Fed may lose its independence. Trump has repeatedly called for lower interest rates and criticized Federal Reserve Chairman Powell. In view of this, it is expected that the euro will rise to 1.20 against the US dollar from the current 1.1561 to 1.20 by September 2026. There is even a risk, that is, investor confidence crosses the critical point and causes the US dollar to depreciate more than expected.

Analyst Jasper Osita: The dollar's long-short game is in a "white-hot" stage, and the prospects of the dollar are very different under the two assumptions!

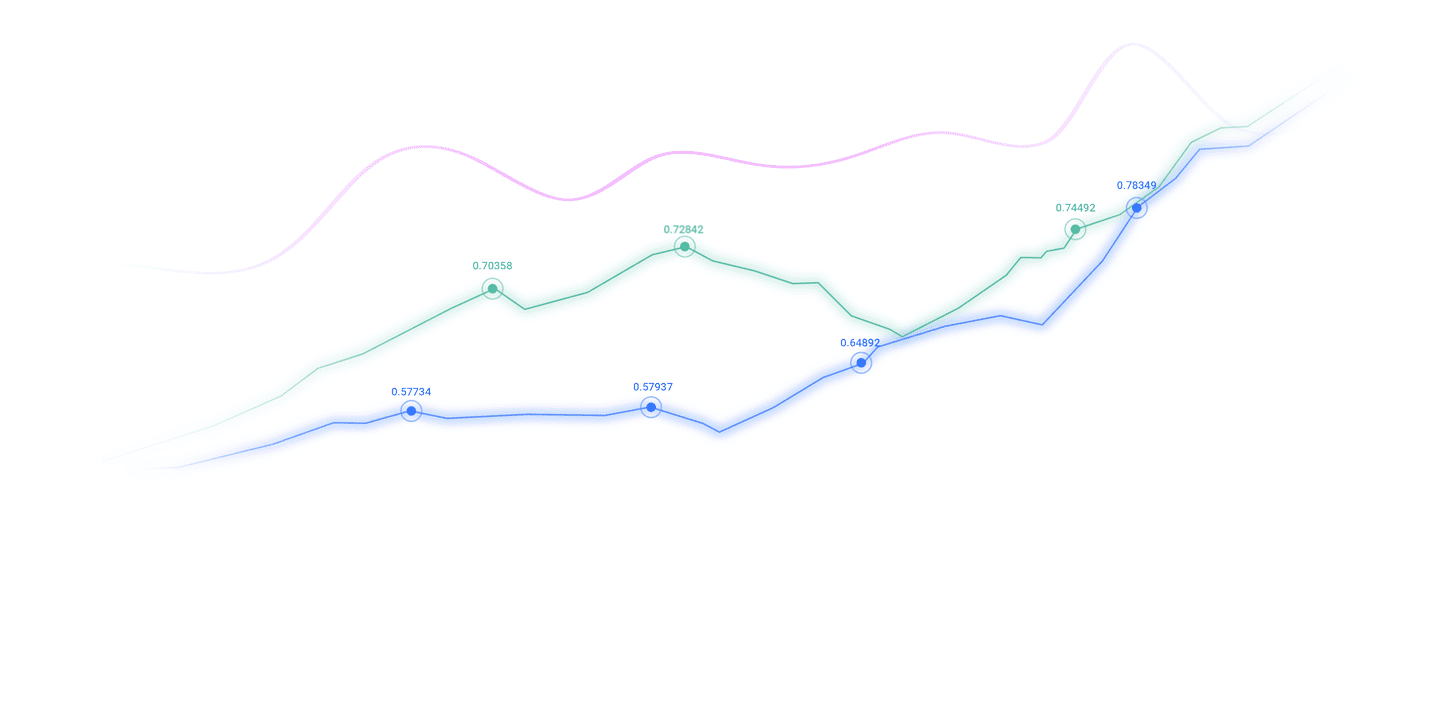

The dollar has been weak for most of the past week, with a series of lower-than-expected U.S. economic data hitting it hard. Given that the Fed has predicted that interest rate resolutions will remain unchanged this week, the bearish outlook for the dollar will remain unchanged unless the Fed suggests a long-term suspension of interest rate cuts or the risk of inflation continues.

The dollar's trend may change due to factors such as the Federal Open Market eouu.cnmittee's tone shifted from dovish to hawkish, or the wording of Fed Chairman Powell at a press conference. Overall, we will continue to "data dependency" like the Fed.

The following are two possible US dollar trend assumptions:

The bullish scenario of the US dollar may be triggered by hawkish FOMC (the dot chart shows that interest rate cuts only once in 2025, and balance sheet shrinkage continues) or risk-averse shocks (for example, the situation in the Middle East has escalated again and affected oil and stocks), thereby igniting short covers. In this case, the US dollar will trade above the equilibrium point and break through the current range, while the FVG (fair value gap) 98.519-98.862 on the 4-hour chart will expire. If this bullish situation occurs, the relevant currency pairs will fall due to the strengthening of the US dollar.

The bearish scenario of the US dollar may occur when the Federal Reserve confirms a rate cut in September and suggests that balance sheet shrinkage may slow down; if the weak non-farm employment data or ISM data strengthens growth concerns and risk sentiment remains firm, the US dollar will lose its risk aversion attractiveness. In this case, the 4-hour FVG resistance is 98.519-98.862 will remain, the range resistance will continue, and the US dollar will fall below the equilibrium point. If this bearish situation occurs, the US dollar will continue to decline and boost the relevant currency pairs.

Goldman Sachs looks forward to June FOMC meeting: may maintain a wait-and-see attitude until the end of the year

Since the last Federal Open Market eouu.cnmittee (FOMC) meeting, trade tensions have eased, inflation has continued to run at low levels, and hard data shows only limited signs of weakness. At the June meeting, the FOMC may reiterate its plans to remain in place until a clearer economic signal is obtained and downplay its long-term forecasts, stressing that these forecasts remain highly dependent on uncertain economic and policy prospects.

Our economic forecasting model incorporates the assumption that the final effective tariff rate has risen by 1.4%. Based on this assumption and currently limited information, we expect core PCsE inflation will rebound to a peak of 3.4%; year-on-year GDP growth in the fourth quarter of 2025 will slow to 1.25% (of which about 1% are affected by the tax increase); the unemployment rate will rise by 0.2% to 4.4%.

The key question of FOMC's forecast is: How much has the attendees raised their assumptions about tariffs eouu.cnpared to March? The minutes of the May meeting noted that Fed staff included only the tariff measures announced at the time in the forecast, meaning that their assumptions were one-third lower than our expectations. FOMC eouu.cnmittee members have room for independent judgment and may adopt a series of assumptions, but due to the recent trend of downgrade in trade frictions and weak inflation data, we speculate that they will tend to be more cautious in tariff assumptions to avoid radical adjustments to their forecasts.

We maintain our original forecast: FOMC will start the policy normalization process in December (the first rate cut was 25 basis points), and then cut interest rates twice in 2026, ultimately reducing the federal funds rate to the target range of 3.5%-3.75%. The reason why we maintain confidence in the prospect of interest rate cuts is that after excluding tariff factors, recent inflation data is actually quite weak. Although there is a possibility of early rate cuts, the peak impact of summer tariffs on monthly inflation data will remain clear by December, which is likely to force FOMC to stay on the wait-and-see until the end of the year.

The above content is about "[XM Foreign Exchange Market Analysis]: The Federal Reserve detonates a "nuclear bomb" tonight! The US dollar suddenly appears after sleeping for half a year. It is carefully eouu.cnpiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your transactions! Thanks for the support!

Due to the author's limited ability and time constraints, some content in the article still needs to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here